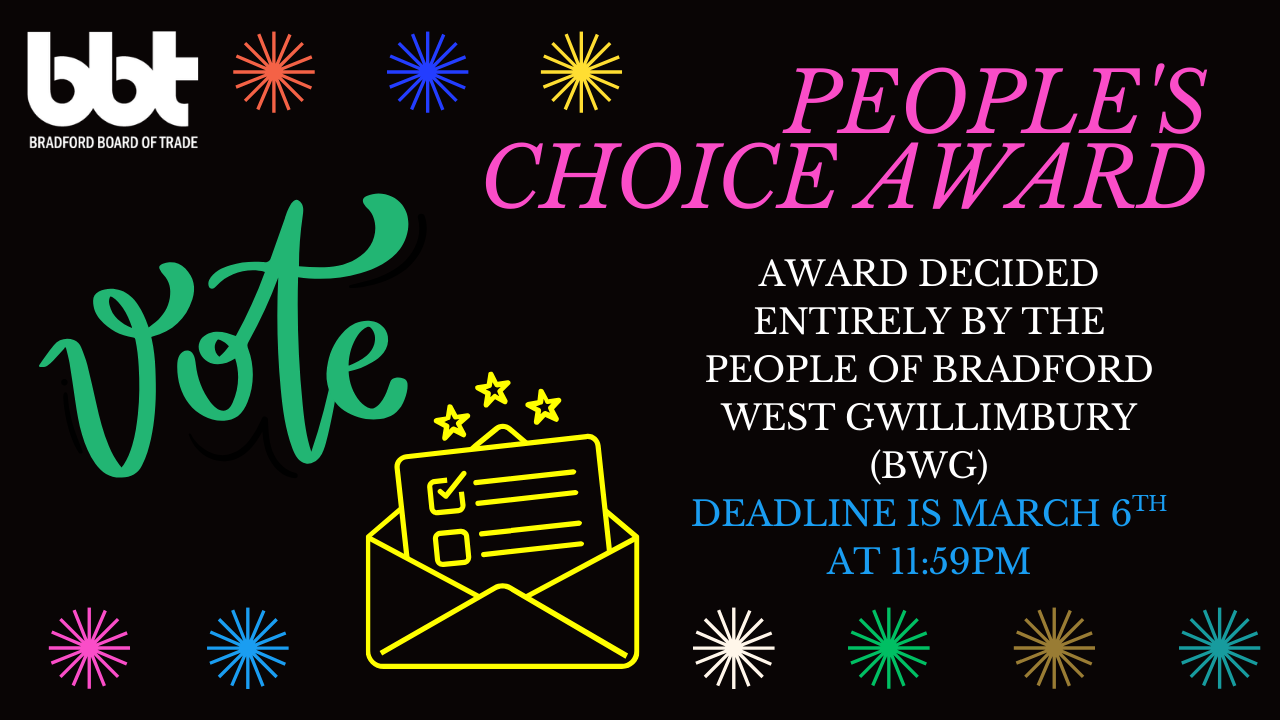

THANK YOU FOR VOTING IN THE PEOPLE’S CHOICE AWARD FOR 2025 – THE VOTE IS NOW OPEN!

GALA DETAILS COMING SOON!

Welcome to the 2025 People’s Choice Award Vote! Each year, the Bradford Board of Trade (BBT) collects nominations from the public across 15 different business award categories and 2 student awards. The People’s Choice Award is special—it is the only award decided entirely by the people of Bradford West Gwillimbury (BWG).

How to Vote:

- Please enter your vote below.

- Vote as many times as you like, but you will be required to verify each vote via email for it to count.

Important Dates:

- Voting closes on Friday, March 6th, 2026, at 11:59pm.

Important Notice Regarding People’s Choice Award Voting

The People’s Choice Award gives the power to the public to vote for their most beloved nominee from a selection of exceptional businesses within the Bradford West Gwillimbury (BWG) community. This award celebrates businesses that have garnered genuine support and admiration from their local community.

Voting Guidelines and Integrity:

This year, the voting process will be closely monitored to ensure fairness due to past concerns about unethical voting. It is crucial to remember that the purpose of the People’s Choice Award is to reflect the genuine voice of the public.

The award is not intended for businesses, family members, or friends to artificially inflate vote counts.